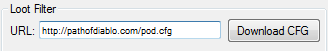

File:Filterinstructions.png

Nobody likes being called a ' Slacker '. And you don't need to be. When it comes to equipment commercial vehicle financing bad credit; my explanation, in Canada a little bit of work and knowledge can take you a long way when it comes to utilizing new assets for profits and sales growth within your firm. Here's what you need to know!

The IRS can also go into your bank account and seize funds. And if you don't have enough to pay your back taxes, they can file a wage garnishment notice with your employer, which will require him to send a certain portion of your pay check to the IRS. We told you they didn't mess around!

There are various websites which can offer you proper reviews about these companies. It is very important to choose the company which is suitable for your business. Some people are interested in taking equipment loans from the bank. But there are lots of rules and regulations that these banks follow.

Buy used not new equipment loan and supplies and keep your all important cash flow where it is needed. You can find items hardly used for sale all the time on auction sites, used business stores and on message boards and in forums. Make sure you do not get tricked into an inflated delivery charge though.

Less attractive options for a business owner that might be a last resort are home equity loans, credit cards and equipment finance options. These are less attractive simply because the cost of financing is a lot more than the traditional sources mentioned earlier and one is personally on the line for the debt.

Do you have a website? Surprisingly, many dental offices don't which limits their reach to the community. You don't have to spend thousands of dollars for an elaborate site. It can be done with a minor outlay.

Have you analyzed your debt structure? If you have a variety of debts that require a lot of monthly payments, it could result in a tight cash flow despite profitability. In such a circumstance, you should consider getting a debt consolidation loan. As mentioned earlier, using dental equipment leasing gives you the technical edge you need to prosper and saves valuable cash flow because there are no down payments required.

File history

Click on a date/time to view the file as it appeared at that time.

| Date/Time | Thumbnail | Dimensions | User | Comment | |

|---|---|---|---|---|---|

| current | 19:48, 7 January 2017 | 328 × 51 (2 KB) | GreenDude (talk | contribs) |

- You cannot overwrite this file.

File usage

There are no pages that link to this file.